As your business expands, the question of GST often comes up when you think about and plan ahead for your business. When does it become compulsory for me to register for GST? GST registration is not compulsory for my business, but can I still register because it will help me lower my business costs? What are my duties as a GST registered business?

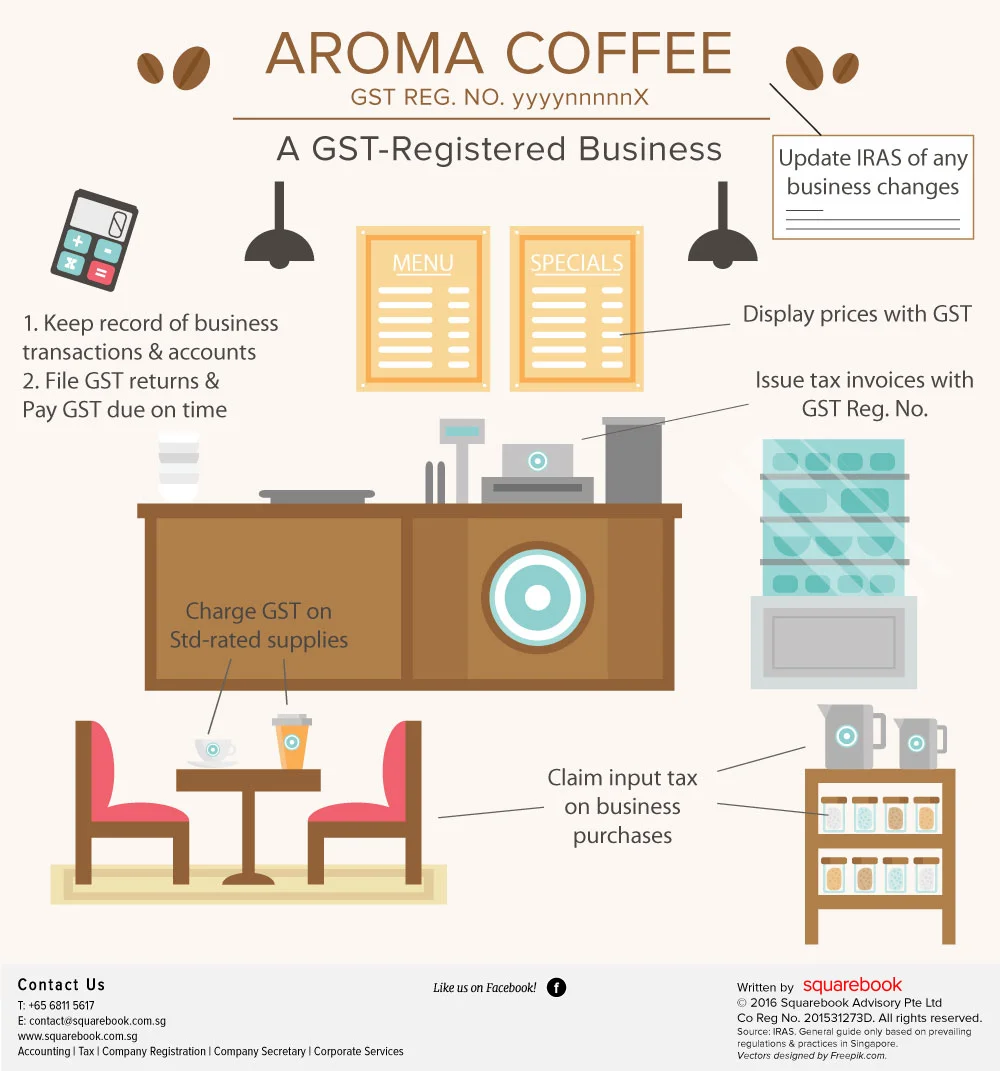

We help to address these questions in the following sections and show you in the form of an infographic the responsibilities of a GST-registered business.

When do I need to register for GST?

GST is a self-assessed tax and businesses are responsible for monitoring when its obligation to register for GST arises. GST registration can be compulsory or voluntary.

Compulsory Registration

It is compulsory to register for GST when:

- At the end of a calendar quarter, your taxable turnover for the past 12 months exceeds S$1 million (this is known as the Retrospective view)

- You can reasonably expect the turnover of your business to exceed S$1 million over the next 12 months e.g. you have signed a high value sales contract (this is known as the Prospective view)

Under compulsory registration, businesses are required to register and notify IRAS within 30 days, failing which penalties will be levied.

Voluntary Registration

If you do not fall into the category for compulsory registration, you may still register on a voluntary basis. This is if it is overall beneficial for your business to be GST registered and you meet the conditions and requirements.

You can register for GST voluntarily if your business meets any of the following:

- You make taxable supplies

- You make only out-of-scope supplies (goods do not enter Singapore)

- You make exempt supplies of financial services that are international services

Once a business is voluntarily registered for GST with the IRAS, it must remain registered for at least two years and also discharge the responsibilities required of a GST registered business. Hence, it is important to consider all factors carefully before registering.

Responsibilities and Duties of GST registered businesses

1. Charge GST on standard-rated supplies

As a GST registered business, you will need to charge GST on the supply of goods and services made in Singapore (standard-rated supplies). This includes trading goods sold to customers in Singapore, as well as other business transactions such as sale of your capital assets (e.g. equipment).

2. Display prices with GST

You are required to display prices that are inclusive of GST amounts. This applies to all menus, advertisements, pamphlets and quotations where prices are indicated.

3. Issue tax invoices with your GST registration no.

The business’s GST registration number needs to be printed on all tax invoices and receipts issued to customers.

4. Keep record of business transactions and accounts

You will need to keep records of all business transactions and accounts. These business and accounting records are required for the preparation of the GST returns and need to be maintained for at least five years, during which the IRAS can audit them. Hence, it is important to ensure that records and accounts are done up and kept in a proper manner.

5. File GST returns and pay GST due on time

As a GST registered business, you need to make GST returns via e-filing and pay GST due to IRAS within 1 month after the end of each GST accounting quarter. There are penalties for late filing and late payment.

6. Claim input tax on business purchases

The input tax claims should be reflected in the GST return for the relevant quarter in which the expenses are incurred. Examples of business expenses include goods purchased for resale to customers as standard-rated supplies, furniture acquired for your business use. However, under the GST regulations, not all purchases are allowed for input tax claim. E.g. input tax claims for motor car expenses and medical expenses incurred by employees are not allowed.

7. Notify IRAS of any business changes

You will need to notify the IRAS within 30 days of changes to your business e.g. when there is a change in the business registered address, business name or ownership.

IRAS imposes additional requirements for voluntary registration (e.g. GIRO is compulsory) and can also require other conditions to be met.

Figuring out GST requirements can be tough when you are unfamiliar with the regulations. We can help you to make the GST registration application for your business and assist with your quarterly filings. Contact us at 6811 5617 for more information.